This winter term, Union College’s Volunteer Income Tax Assistance (VITA) program is in its 20th year of operation. The program is operated by Professor Mary Okeffe and students in ECO391, Income Tax: Policy and Practice, an upper-level economics course. Over 20 years, the program has generated about $8 million in tax refunds for Schenectady and Albany residents.

VITA is a national program run by the IRS to offer free basic tax returns to qualified taxpayers. To be eligible for the program, taxpayers must have a household income of $67,000 or less, be disabled, or speak limited English. Volunteers at these tax sites pass basic and advanced tax law certification tests and adhere to confidentiality and ethics standards. Most programs are run at professional schools and charities.

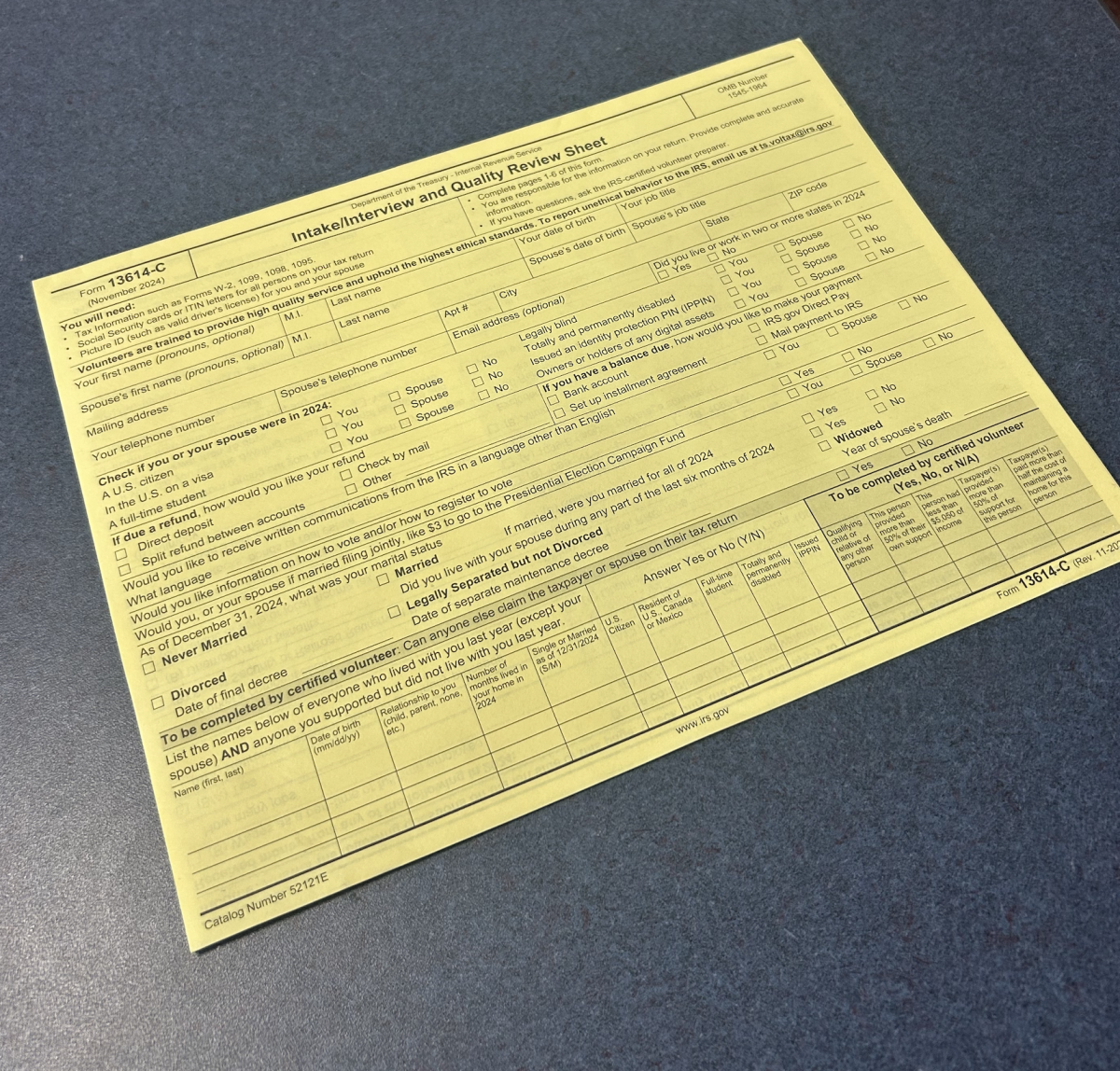

Clients come to the tax sites with wage information (such as W2s and 1099 forms), evidence for tax deductions (such as 1098 forms and daycare expenses), a social security card, and a valid ID. At Union’s VITA site, volunteers take photos of these documents and prepare the clients’ tax returns offsite. Another volunteer will then check over the completed tax returns before the client reviews the returns and approves them for filing with the IRS.

The program began at Union in the winter of 2005, and Professor Okeffe has led it since winter 2006. The program has seen significant growth and changes since its inception. When the program began, it was run at the Kenney Community Center, which many clients struggled to locate. In addition, clients had to wait at the center while volunteers prepared their tax returns, which meant that some clients were at the site for hours.

Now, the program is run at the Schenectady County Public Library, within walking distance of several homeless shelters. Clients no longer have to stay with volunteers as they prepare their tax returns, but the returns have become significantly more complicated. Since its inception, the US government has passed various tax laws, such as Obamacare and education tax credits, making the tax return process more complicated. “The Pub 4012 Volunteer Resource Guide (aka the ‘VITA Bible’ the IRS requires us to use as a reference) is now 376 pages long. It was about 70 pages in 2004,” Professor Okeeffe explained.

“ I really appreciate being able to help people and having the hands-on experience of learning taxes and the tax code, but also being able to explain it to people,” Dina Saef ‘25, a student volunteer in the program, remarked. “ It’s really nice to have that hands-on experience, be active, and speak with people in the community, and how we can support them.”

This season, the program continues to accept clients and help them obtain thousands of dollars in tax returns. In the coming years, the program hopes to continue serving clients throughout the Schenectady area.