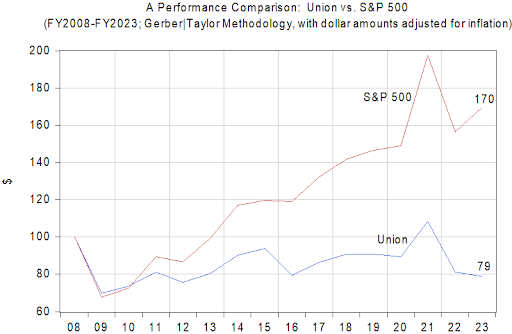

The February 2024 report released by Eshragh Motahar, Union Professor of Economics, shows the school’s endowment has underperformed the S&P 500, the U.S.’s baseline stock market index by 13 percentage points in the 2023 fiscal year (FY 2023). By the end of said year, the endowment was valued at $522 million. In addition, Union reports a lower rate of return than the median rate of return for endowments in 2023, with Union’s sitting at about 6.6%, compared to the population’s 8.6% median. According to Motahar’s report, the value of Union’s endowment, adjusted for inflation, in FY 2022-2023 was approximately $20 million lower than it was in 2008.

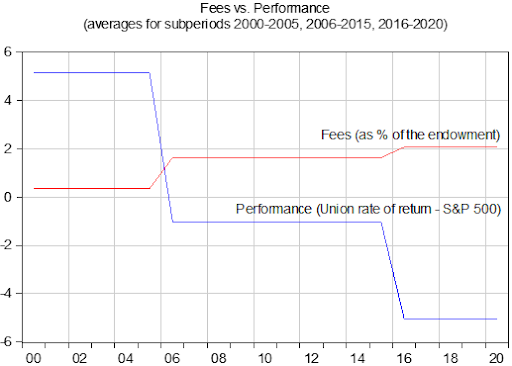

The following graph demonstrates Union’s performance and the fees that were paid to investment managers—the data for which has been withheld since 2021.

As the endowment report published by Professor Motahar demonstrates, several experts in the fields of financial markets and endowment management disagree with Union’s current investment strategy.

Several faculty members share concerns regarding the management of the endowment. John Cramsie, Professor of History at Union, noted, “There is a substantial body of research that demonstrates active management is less effective than passive management strategies: lower returns, higher management fees, and lucrative income streams for managers regardless of performance.” Cramsie continues, “The last lines of defense of active management are, one, investment professionals are experts and know best, and two, everyone else is doing the same thing. The first is not supported by empirical evidence and the second is the kind of argument you get from bad actors attempting to excuse unethical behavior.”

Keeping track of the endowment is vital for the current student body as well. This not only affects the overall reputation of the institution but directly influences the services provided by the school. Furthermore, there exists a relationship between endowment performance and tuition increases. In order to compensate for the financial losses experienced as a result of endowment performance, Union will have to increase tuition. In contrast, if the endowment performs well, students will be able to enjoy better quality services.

In my communication with several alumni, I noticed a pattern of growing concern over this matter. Viola Li ‘24 shares, “As a local student with close connections to The College of Saint Rose that recently shut down, I worry about the College’s potential to decline due to financial issues.” Harry Berger ‘23 states, “This is completely irresponsible and unacceptable. No one that I have spoken to from my time at Union has had a good explanation for the endowment’s recent performance.” Speaking from an alumni perspective, Harry continues, “The main concern for the alumni right now is that we are not confident that our contributions to Union will not be wasted by these unknown managers;it is a deciding factor in whether we choose to donate.” In addition, Serina Beebe ‘22 shares these concerns. “Union is continuing to ask individuals, both students and alumni, for money through donations and fees, but their ask is increasing,” Serina states. “I am also highly curious as to why a portion of the endowment is sitting in the Cayman Islands”, she says.

To aggravate the issue, in 2020 around 54% of Union’s endowment was invested in the Cayman Islands. In 2021, this percentage abruptly fell to 30%. Since then, there has been no further data regarding the percentage of endowment that is invested there. The important thing to note here is that the Cayman Islands are infamously known for being a tax haven. Mohammad Mafi, Professor of Engineering, commented on this “A concern that I have is Union’s link to the Cayman Islands, which are perceived to be tax havens. I fail to understand the need to be registered in the Cayman Islands.”

The issue of transparency remains central to the conversation surrounding Union’s endowment. Since Professor Motahar’s first report in 2021, it has become increasingly difficult to gain any sort of clarity on the matter from the administration. As of fiscal year 2021, the college is not reporting its investment management fees. However, when it did report, investment fees as a percentage of the endowment increased by 491% during the 2000-2020 period, while, during the same period, performance has deteriorated by 198%. The last endowment management fees reported were $14.6 million in fiscal year 2021, when fees are normally far lower. This informational asymmetry by the college must end, and stakeholders must be given the opportunity to understand how these decisions are made, and who makes them. The fact remains that, to date, we do not know who these investment managers are, how much they are paid, or why they insist on using this particular investment strategy.

There have been no specific answers to questions that have naturally arisen as a result of reading this information. I encourage Union’s administration to provide clarity on these concerns to all stakeholders of Union College and to engage with the evidence provided.

For a better understanding of the long-term performance of Union’s endowment, as compared to a widely used benchmark, the S&P 500, see the graph below. Note that the amount of investment management fees paid by Union, for this performance, during the 2008-2023 period, was over $100 million.