In our everyday lives, unpredictability and chance are often present. Whether it’s predicting tomorrow’s weather, or guessing the outcome of a dice roll, an element of randomness is involved. In the financial world, this randomness, especially in stock prices, is a reality that investors and analysts contend with. Experts have turned to tools like Stochastic Differential Equations (SDEs) to understand better and predict stock-price movements to deal with this uncertainty.

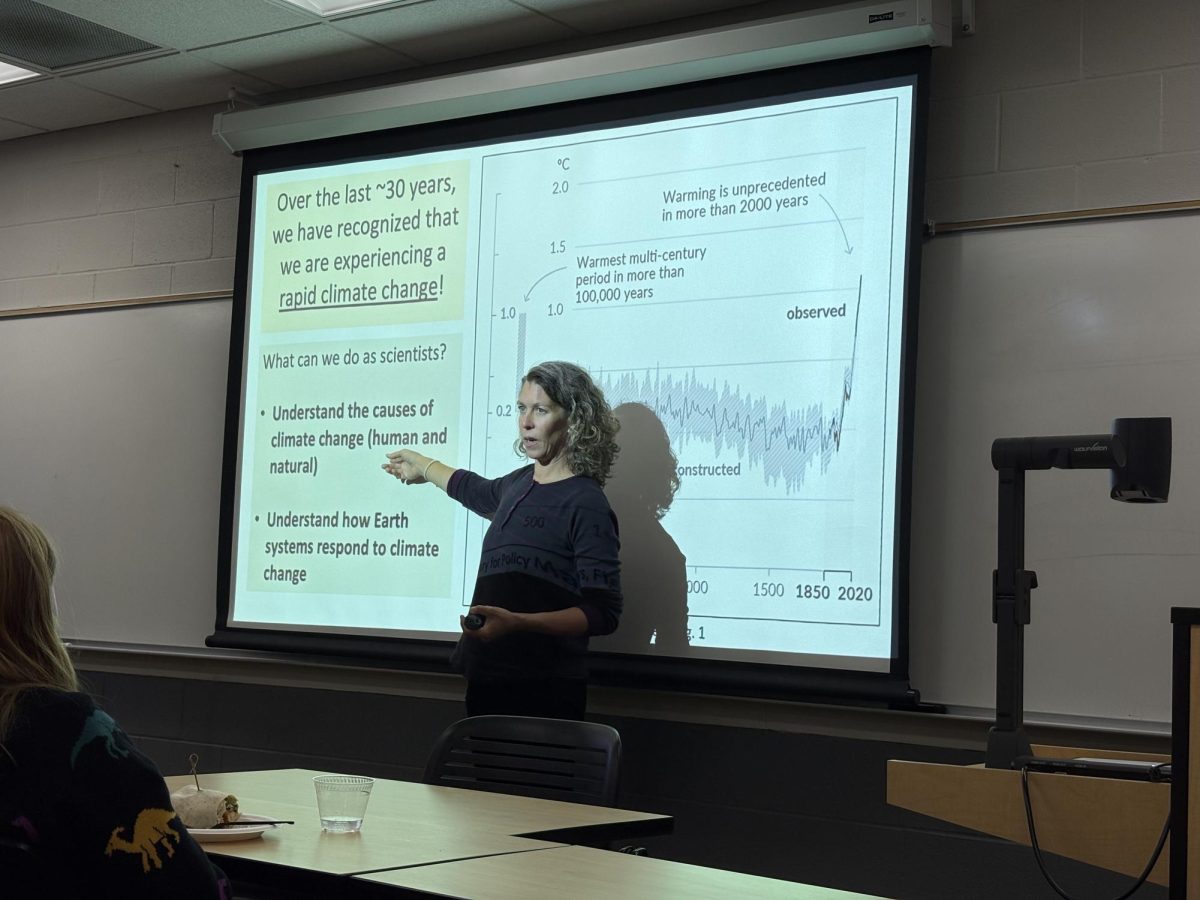

I first came across this concept while working on a research project over the summer, and became fascinated with it after attending Professor Leon Tatevossian’s seminar about the Diffusion Processes and the Evolution of the Stock-Price Model. Having worked in Finance, Risk Engineering, and Quantitative Finance, prof. Leon offered depths of knowledge and unique perspectives, considered a pioneer in the industry.

At its core, an SDE is an equation containing deterministic and random components. The study of stock-price dynamics often involves looking at historical behaviors and combining them with specific probabilistic models to predict future behavior. Here, the historical behavior might involve studying past stock prices to see patterns or volatility. In contrast, the probabilistic model gives a structure or a set formula into which this historical data is fed to predict future stock prices.

The use of SDEs isn’t limited to the stock market. They can be applied anywhere there’s a system with randomness, from physics to biology. In finance, they’re mainly used for option pricing, risk management, and any situation where assets, like stocks, have prices that evolve over continuous time with uncertainty. One of the most well-known SDEs in finance is the Black-Scholes model, primarily used for option pricing. An option gives you the right to buy or sell a stock at a specific price in the future. To price this right, traders use SDEs to model potential stock price movements and determine a fair price for the option.

Another application is in risk management. Financial institutions use SDEs to simulate various economic scenarios and understand potential future risks, helping them make more informed decisions about where to invest or how much to lend.

However, there are some challenges to its validity:

- Assumption of Constant Volatility: The model assumes that the volatility is constant over time. However, stock-market volatility is far from constant and can vary dramatically in short periods: from geopolitical events, to tweets from influential personalities. Capturing all this in a single model is challenging.

- Lognormal Distribution: The Black-Scholes model assumes that stock prices follow a lognormal distribution, meaning that stock prices can theoretically become infinitely large. However, they can’t fall below zero. This assumption might only sometimes hold in real-world scenarios.

- Economic argument: Economic arguments like the impact of interest rates, inflation, or changes in industry regulations can bring sudden shifts in stock prices, which may not always align with what an SDE might predict.

- Risk-free Rate: The model also assumes a risk-free rate, implying there’s a place where investors can invest money without any risk, which, in reality, might not be the case.

Stochastic Differential Equations provide a window into the complex world of stock-price dynamics. Blending historical analysis with probabilistic models offers insights into how prices might evolve. However, while models like Black-Scholes have proven valuable, they’re not infallible. As with any model, it’s crucial to understand at the end of the day, these are just tools. For any investor or policy-maker, a holistic approach that combines both mathematical models with an overall understanding of the real-world events will always be the best strategy.